April 2023 East Bay Market Report

Market Update

Market Update

Note: You can find the charts & graphs for the Big Story at the end of the following section.

Look, we've all been there. You’re running a prominent regional bank that holds an outsized amount of uninsured deposits, which are overly concentrated in the tech sector, all while holding a huge, unhedged, long-dated bond portfolio that has taken a major hit over the past year due to rising interest rates. Then you’re forced to sell that portfolio, realizing a major loss, to provide liquidity to your depositors who need to withdraw their money to pay their bills after venture capital stops flowing. The major loss leads to a modern-day bank run and seizure of the bank by U.S. regulators, creating a domino effect that causes another bank failure and widespread concerns over the systemic risk of the banking system. Of course, this may not describe you exactly, but the story may sound familiar, and you may be wondering if the uncertainty in the banking system affects you. The answer is probably a familiar one: maybe.

It's true that banks are tightening their credit standards to hold more liquid assets on their balance sheets, which may make them a little less willing to lend out money. However, it's important to note that credit has been tightening for over a year now due to rising interest rates, and banks often sell their mortgages through Mortgage-Backed Securities (MBS), which means they don't have to hold onto long-term loans on their balance sheets.

Now, if you're a creditworthy homebuyer who qualified for a loan before the bank failures, chances are you still qualify today. While the recent failures of Silicon Valley Bank and Signature Bank may cause some uncertainty, we don't expect any major moves in mortgage rates in the short term. So don't worry too much - if you're ready to buy a home and have a solid credit history, you're likely still in good shape.

The Fed recently met right after the bank failures, and they decided to raise their benchmark rate by 0.25% - this was actually less than what many people were anticipating. They did this as part of their ongoing efforts to combat inflation, which is still above their target rate of 2%. However, since banks were already tightening their credit standards after the bank failures, the Fed felt they didn't need to raise rates too much as well.

The good news is that inflation is steadily coming down and should be back to the target rate in about a year, based on current trends. However, one thing that could slow down this decline is OPEC's recent announcement that they are cutting oil production, which will likely cause gas prices to increase in the coming months.

All in all, it looks like interest rates will remain elevated and somewhat volatile over the next 12 months, and mortgage rates specifically will likely hover around 6-7%. It's important to keep an eye on these trends if you're planning to buy or refinance a home, but don't worry too much - with the right planning and a solid credit history, you can still find a great deal on a mortgage.

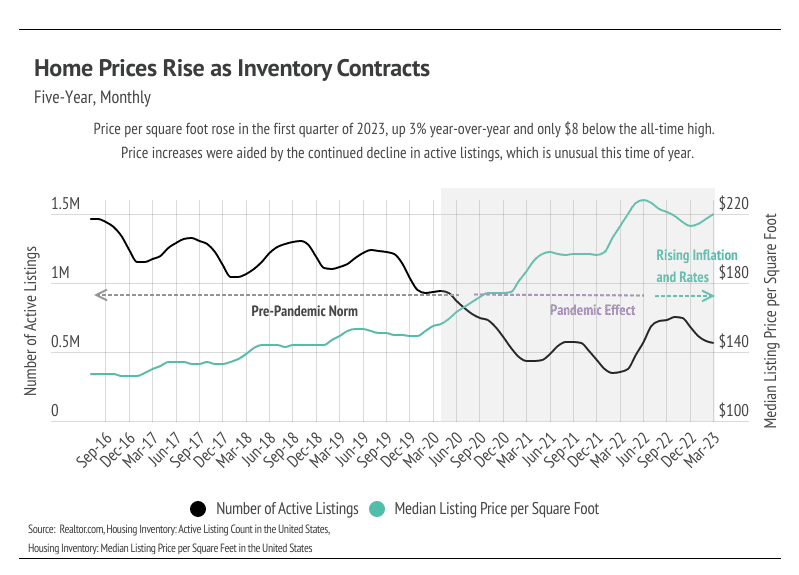

Despite the 30-year average mortgage rate being above 6% for the past six months, a significant number of buyers are finally coming back to the market. In fact, according to the National Association of Realtors (NAR), sales jumped 14.5% in February - the largest month-over-month increase since July 2020. This is a great sign, and it breaks the 12-month streak of declining sales.

There are a few factors that we can attribute to this increase. First, the initial sticker shock of higher rates has worn off, and buyers are getting more used to the idea of higher rates. Second, the time before buyers refinance has shortened, which means they can take advantage of lower rates sooner. And third, typical seasonality has returned, which always brings more buyers into the market.

As inflation continues to decline, the Fed has offered a clearer picture of their plans for interest rates. They plan to raise the federal funds rate through 2023 to around 5.5%, and then gradually lower rates by about 2% over the course of 2024 and 2025. This is good news for buyers who are hoping to refinance, as they now have a better idea of when they can expect lower rates. As you may know, the monthly mortgage cost is reduced by 10% for every 1% decrease in the mortgage rate. So, buyers can greatly reduce their monthly costs as rates fall.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage of your area. In general, higher-priced regions have been hit harder by mortgage rate hikes than less expensive markets due to the absolute dollar cost of the rate hikes. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Inventory in the East Bay has increased in February and March, which is great news for buyers who are searching for their dream home. The East Bay has a strong demand for housing, and we believe that there is still room for more homes to enter the market before the supply meets the demand. As we move into the second quarter, we expect to see sales pick up even more with the influx of new listings. However, with increased demand, buyers should be prepared for competition and potentially higher prices. It's important to note that while single-family-home prices in the East Bay are still below their all-time highs, condo prices are already close to peak levels. If the supply of homes unexpectedly declines, we could see a significant increase in prices, particularly for single-family homes. We'll continue to keep a close eye on the market, and we look forward to helping buyers and sellers navigate this exciting and dynamic time in the housing market.

It's great to see that total inventory has risen over the past few months, although it's still lower than we'd like. We know that the recent surge in sales and low-interest rates has created a challenging market for buyers and sellers alike, making it more difficult for homeowners to decide whether to sell or stay put. After all, moving and financing at higher rates can be daunting. However, as interest rates have remained elevated for a while now, we're seeing more and more buyers returning to desirable markets like the East Bay's.

In fact, sales in the area increased by a whopping 50.8% from February to March, which is truly remarkable! We believe that this is partly due to the fact that more new listings are hitting the market, which is helping to balance out supply and demand. While the market may not be as hypercompetitive as it was in 2021, there's still some healthy competition among buyers. Despite this, we do anticipate some inventory growth in the second quarter of 2023. However, we recognize that inventory levels will likely remain low relative to demand throughout the rest of the year.

It's great to know more about the Months of Supply Inventory (MSI) and how it helps us understand the supply/demand balance in the market. It's impressive that the long-term average MSI in California is around three months, which represents a balanced market. However, it's good news for sellers that MSI dropped in February and March for both single-family homes and condos, indicating a market that strongly favors sellers. This was likely due to increased sales and less time on the market, which is exciting to see. I'm sure this news will be encouraging for those looking to sell their homes in the current market.

Stay up to date on the latest real estate trends.

Market Update

Agent of the Month

Market Update

Real Estate

Real Estate

Market Update

Real Estate

Market Update

Real Estate

You’ve got questions and we can’t wait to answer them.